A One Person Company (OPC) is a type of business entity that allows a single individual to operate and manage a company with limited liability. It provides the benefits of a corporate structure, such as limited liability, while also allowing the entrepreneur to have full control over the company's operations.

In OPC, there is only one shareholder who is also the sole director of the company. This individual can enjoy the benefits of limited liability, meaning their personal assets are separate from the company's liabilities. This protects the personal assets of the owner in case the company faces financial difficulties.

OPCs are popular among solo entrepreneurs who want the benefits of a corporate structure without the complexity of having multiple shareholders and directors. However, there are certain restrictions and requirements imposed on OPCs depending on the jurisdiction, such as minimum capital requirements and mandatory conversion to a private limited company if the company exceeds certain thresholds in terms of turnover or paid-up capital.

one person Company -Incorporation Certificate [sample]

One Person Company or "OPC" is a kind of private limited company which is registered under the Companies Act, 2013. It can be registered with a single person who acts both as the director as well as shareholder of the company. OPC company use "opc private limited" or "opc pvt ltd" at the end of their company name because it is a private company owned by single person. Earlier in a private limited company, a minimum of 2 directors and 2 members were required. A single person could not form a private company. But a new concept of OPC was introduced as per Section 2(62) in the Company's Act 2013 where a single person can form a private limited company.

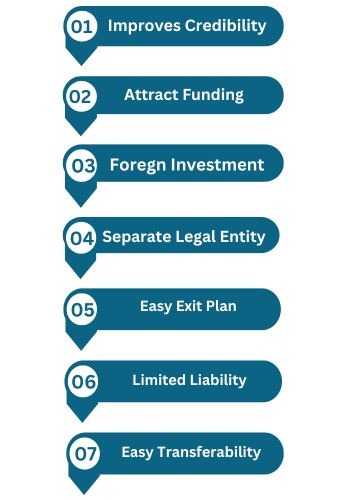

Take a closer look at the benifits of LLP egistration in India

An LLP is a separate legal entity from its partners. It is a major benefit that is not available for partnership firms.

helps in protecting the personal assets of the owners with limited liability protection.

The cost of registering an LLP is comparatively lower than a private limited company.

An LLP can be formed with the least amount of capital as there is no minimum capital requirement for forming an LLP.

One of the key benefits of registering an LLP is lower compliance requirements. Mandatory criteria for annual compliances of an LLP are on the lower side as when turnover is less than 40 lakhs, LLP audit is optional.

As per the Companies Act 2013, there are minimum requirements that need to be met for one person company incorporation online.

For incorporating your business as a One Person Company, you need to provide proper identity and address proof. The documents are required to be submitted to the Registrar of Companies.

Post incorporation of one person company, you'll receive the following documents: